- Home

- Who We Are

- Financial Services

Financial Services

- Blog

- Contact Us

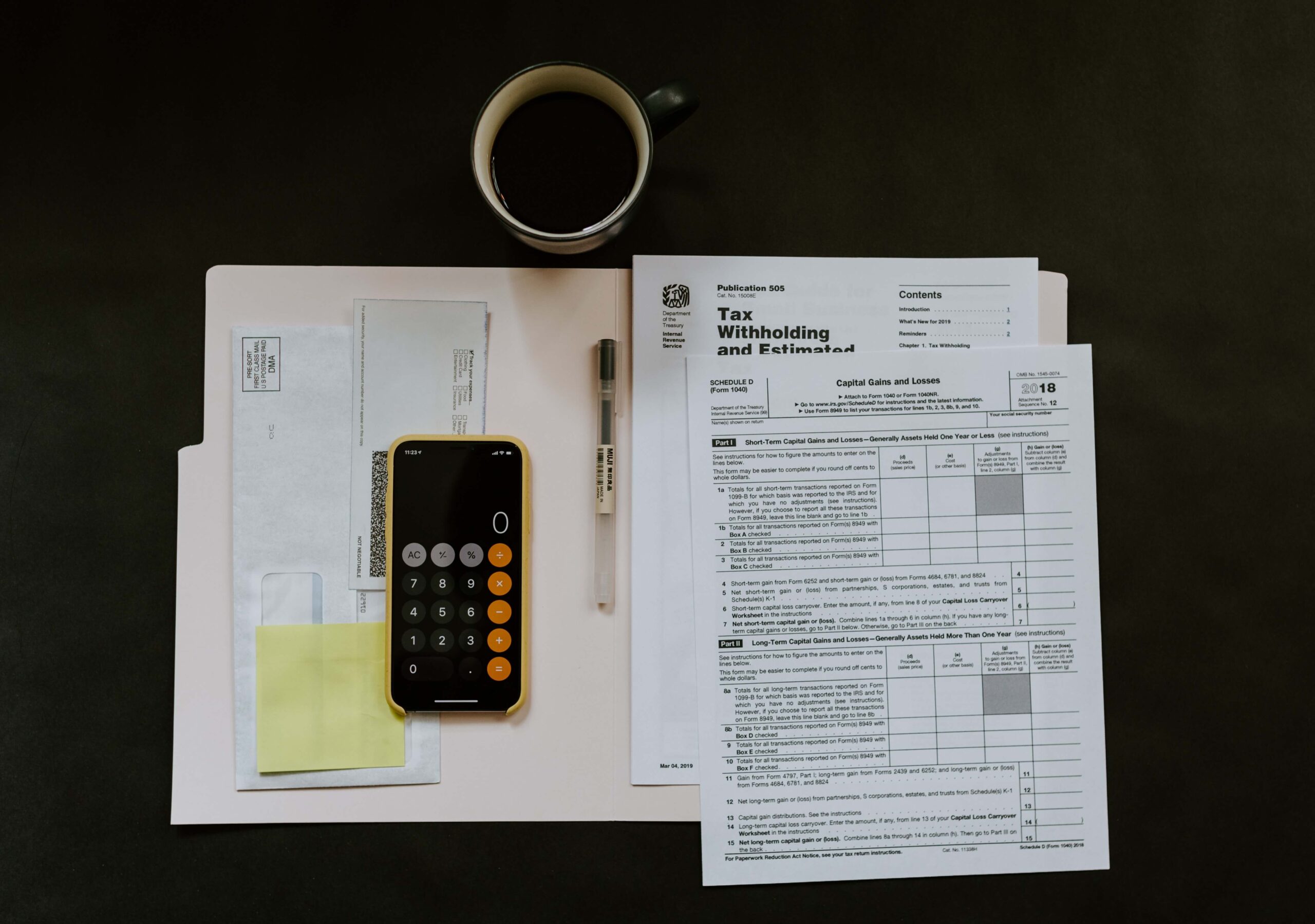

As superannuation is forced retirement savings, it is designed not to be accessed until you reach preservation age (60 years of age). However, there are a small number of reasons you can gain access to your superannuation before you retire.As superannuation is forced retirement savings, it is designed not to be accessed until you reach preservation age (60 years of age). However, there are a small number of reasons you can gain access to your superannuation before you retire. Seeking superannuation advice from a professional can help you understand the implications and alternatives to accessing your super early.

Generally, we would recommend budgeting and cash flow management first. A lot of the time, we do not know where all our money is being spent. Writing everything down and accessing what is critical and what is not can have the desired result. Utilising your superannuation should be the last resort.

Carry-forward contributions are not a special type of super contribution, they simply allow super fund members to use any of their previously unused concessional contributions cap (or limit) on a rolling basis for five years.

This means if you don’t use the full amount of your concessional contributions cap ($27,500 in 2021–22), you can carry forward the unused amount and take advantage of it up to five years later. (From 1 July 2017 to 30 June 2021, the annual general concessional contributions cap was $25,000.)

OakView Financial provide an obligation-free consultation. Don’t hesitate to call or message us.

Salary sacrificing is when employees choose to set up these types of arrangements with their employer. The employee forgoes part of their salary or wages to help pay for a range of benefits like cars, school fees or extra super contributions. To make the most of this strategy, it's important to seek superannuation advice from a professional who can guide you on the best approach for your situation.

To sacrifice some of your salary into your super account, you make an agreement with your employer for them to pay some of your salary straight into your super fund rather than into your bank account with the rest of your salary. This means the money going into your super account is from your pre-tax salary.

Are made from before-tax income and are taxed at 15% in your super fund. Common examples of concessional contributions include:

Are made from after-tax income and are not taxed in your super fund. Common examples of non-concessional contributions include:

There are annual caps (limits) on the amount of concessional and non-concessional contributions you can make. You’ll be liable to pay extra tax if you exceed these limits.

The forthcoming tables show the super balance required to provide a couple or a single person with an annual income of $60,000. Using MoneySmart’s Retirement Planner, we’ve calculated various scenarios, depending on how long you want your money to last and the average annual return on your super investments, net of all fees.

For simplicity, we have not counted savings and investments held outside super. If you have significant outside savings, you will need less super. We also assume you own your home.

We also look at outcomes based on whether or not you will become eligible for the Age Pension at some point as your savings are run down.

The results are based on someone retiring at 67 but apply to anyone who is over Age Pension age (currently 66 years and 6 months). All figures are in today’s dollars (adjusted for inflation), assuming an average annual 2.5% rise in the cost of living and an additional 1.5% rise in living standards per year.

Are you one of the 4 million Australians that have two or more super accounts? According to the ATO, of the 16 million Australians that had superannuation in 2021, the vast majority (73%) have only one account, but there are still 20% that have two accounts, 5% that have three accounts and 2% that have four or more super accounts.

The good news is that the number has decreased since 2017, when only 61% of Australians had just one account.

Why does this matter? The simple answer is that multiple accounts will cost you more in fees and reduce your retirement savings.

OakView Financial offers a complimentary super fund search and assists in getting your super into a single appropriate superannuation fund.

When you reach your preservation age and retire, you can access your super to fund your retirement.

You can also access your super:

You don’t have to cash out your super just because you’ve reached a certain age, however, you need to check if the rules of your particular super fund specify otherwise.

Your preservation age is not the same as your pension age. Your preservation age is the age you must reach before you can access your super and depends on when you were born.

The tax payable on super benefits depends on a number of things, including:

Some super benefits have a tax-free component and a taxable component. The tax-free component generally includes:

ASFA estimates that the lump sum needed at retirement to support a comfortable lifestyle is $640,000 for a couple and $545,000 for a single person. This assumes a partial Age Pension.

ASFA estimates that a modest lifestyle, which covers the basics, is mostly met by the Age Pension. They estimate the lump sum needed to support a modest lifestyle for a single or couple is $70,000.

However, this might not be enough for you, it is important to seek advice on this with a Financial Planner; the team at OakView Financial can sit down with you and work out your required balance to meet your retirement needs.

It’s fair to assume that the average Australian might hope to live comfortably, if not lavishly, in retirement.

The widely reported ASFA Retirement standard suggests couples can enjoy a ‘comfortable lifestyle’ on around $65,000 a year. It stands to reason then that a single person should be able to live more than comfortably on $60,000.

If $60,000 a year sounds like your kind of retirement, the next step is to work out how much super you will need to fund it. That’s where our expert team comes in.

The Association of Super Funds Australia (ASFA) latest report states the average superannuation balance required for a comfortable retirement is $640,000 for a couple and $545,000 for a single person. This assumes you will withdraw your superannuation as a lump sum and receive a part Age Pension.

However, the average superannuation balance of a 60–64-year-old Australian is $359,870 for men and $289,179 for women. This, unfortunately falls short of the required amount needed to live a comfortable retirement.

The good news is that you still have time to change these numbers; time in the market beats timing the market. By working with a Financial Planner, you can employ strategy’s to boost your superannuation so you can hit all your retirement goals and live that well-deserved comfortable retirement.

The transfer balance cap is a $1.7 million transfer balance cap on the amount of money you can shift into a super pension account. Excess amounts will need to remain in a super accumulation account or outside super, where earnings will be taxed. The interaction of the transfer balance cap with other income and investments can be complex, so we advise you to seek professional advice.

The $1.7 million cap applies to individuals, which means a couple could have up to $3.4 million in individual accounts. However, if a couple has one account between them in a single name, the $1.7 million limit applies.

The Department of Social Services reviews the eligibility for the Age Pension each year, increasing the upper limits to scale with inflation. Australian Parliament may also introduce policy changes to the limits, it is best to review your retirement strategy with your Financial Planner each year to ensure you are always taking advantage of the best outcome.

Give one of our friendly team a call today.

We’re here to help. If you’re looking for something specific, send us a message and we’ll get back to you as soon as possible.